Commercial real estate (CRE) developers move heaven and earth to unlearn their environmentally unsound ways and adopt eco-friendly ones with one goal in mind — to earn sustainable building certifications. Swimming upstream against tried-and-true construction practices can be expensive because the infrastructure needed to erect structures without harming nature needs more time to mature. Yet, prudent developers seek guidance from sustainable building standards to create assets with enduring value.

Various factors influence a piece of CRE’s marketability, but several reasons explain why sustainable buildings command higher prices than uncertified commercial properties.

Proving Climate Resilience

Sustainable building certifications can be an advertisement for resilience to the worst effects of climate change. The fight to curb the consequences of global warming is far from over. The world hasn’t made significant progress in reversing the planet’s rising surface temperature.

The threat of permanent coastal flooding, menacing storms, prolonged droughts, searing heat waves and destructive wildfires is alive. Sustainable buildings are paragons of safety in a warmer future.

Leadership in Energy and Environmental Design (LEED) by the U.S. Green Building Council, the most popular sustainable building rating system, emphasizes climate resilience. Any developer can claim to construct a structure immune to the natural disasters climate change could bring, but LEED certification is one of the few that can lend credence to such a statement.

Only 197,000 projects have received it worldwide. Earning this distinction puts a building in an ultra-exclusive club.

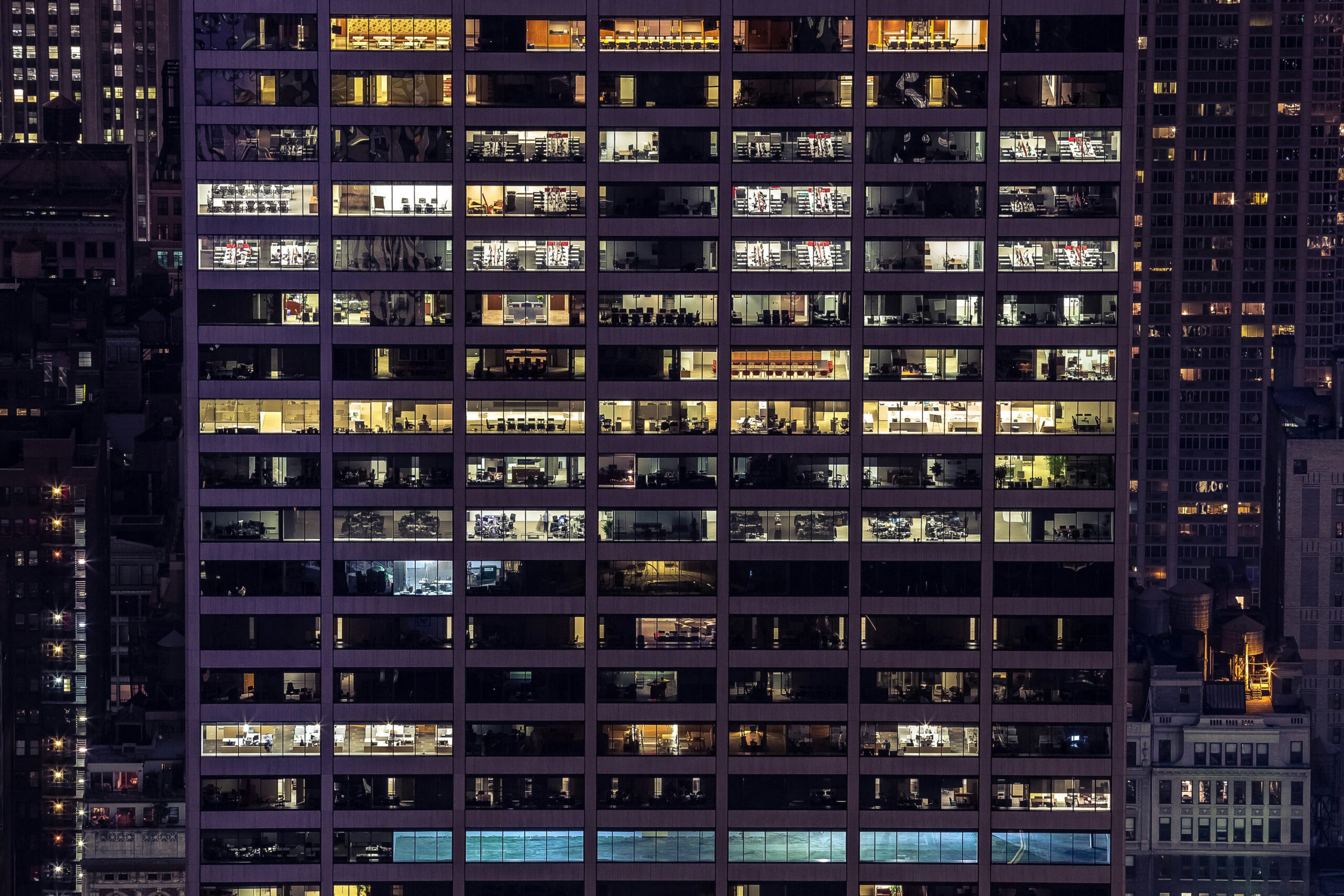

Consuming Less Energy

Certified buildings are almost always energy-efficient. The retrofits many commercial property owners yearn for are their staples — such as green roofs, LED lighting, high-performance windows, continuous insulation, tight building envelopes, solar water heating systems and rainwater harvesting equipment.

Combining these features can make a commercial property more efficient than no less than 75% of comparable buildings, which is good enough to earn an Energy Star certification.

Aside from consuming fewer resources, sustainable properties passively keep their temperature regulation loads low. In summer, they leverage shaded materials with high thermal mass to capture heat from inside the building during the day and release it at night as cool breezes pass over them. These materials can absorb warmth from direct sunlight in winter and reradiate the stored energy overnight.

Sustainable buildings usually have plenty of vegetation. They use landscaping to ease the urban heat island effect, acting as oases in a concrete desert.

Forward-thinking real estate investors are bullish on these commercial properties because they’re resilient to dry spells and energy crises. Businesses willing to sign neat leases and shoulder some or all operating expenses in exchange for lower rents like them, for these assets cost less to run. Overall, they present a win-win solution for building owners and tenants.

Reducing Liabilities

Structures built with materials and furnished with items certified by UL GREENGUARD are bargaining chips when negotiating commercial insurance premiums.

Certified products promote good indoor air quality and building occupant wellness because they emit low levels of volatile organic compounds. These harmful airborne pollutants can be silent killers. Prolonged exposure can lead to cancer and various chronic diseases.

Emitting Fewer Greenhouse Gases

Sustainability credentials matter when performing risk analysis when buying stocks. It can be tricky because the federal government only mandates large-scale emitters to report greenhouse gas emission data. Market participants typically rely on voluntary disclosures to identify which bets are prone to environmental scandals and government action before increasing their positions.

Green building tenancies can be an indicator of environmental responsibility. Many publicly traded enterprises wanting to project an eco-friendly image gravitate toward commercial properties with sustainable building certifications — even though these assets only prove they have minimal Scope 1 emissions. Traditionally built multifamily housing complexes, offices, retail outlets and warehouses won’t cut it anymore. That’s why sustainable buildings are extremely valuable.

Justifying Higher Rents

Buildings that earned the sustainable building certifying bodies’ stamps of approval help their owners attract sustainability-minded tenants and sign them to handsome long-term leases. Sustainable commercial properties are head and shoulders above the rest, magnetizing businesses willing to pay a pretty penny to bear their addresses.

Overcoming Fickle Regulation

The regulatory landscape surrounding CRE is evolving. Pressing health and environmental concerns influence policymaking, so what’s compliant today can quickly become obsolete tomorrow.

Sustainable buildings are highly adaptive to regulatory changes because policymakers turn to domain experts in the fields of sustainability, construction and smart engineering to enact reform. That’s why certified commercial properties are future-proof. Innovative concepts conceive these structures, allowing them to last for decades structurally and legally.

Sustainable Is Synonymous With Valuable

Value stems from scarcity. Sustainable building certifications increasing what audited commercial properties are worth is terrible news because it means there aren’t enough of them on the market. Until eco-friendly standards gain currency worldwide, CRE players must take advantage of these credentials to reap the competitive advantages these structures bring.